The internet has been buzzing with frustration over the “new” 20% tax on savings. Social media is full of angry comments, and clickbait-y headlines didn’t help either. Here’s the truth: the 20% tax on savings interest is not new. It has been there for years.

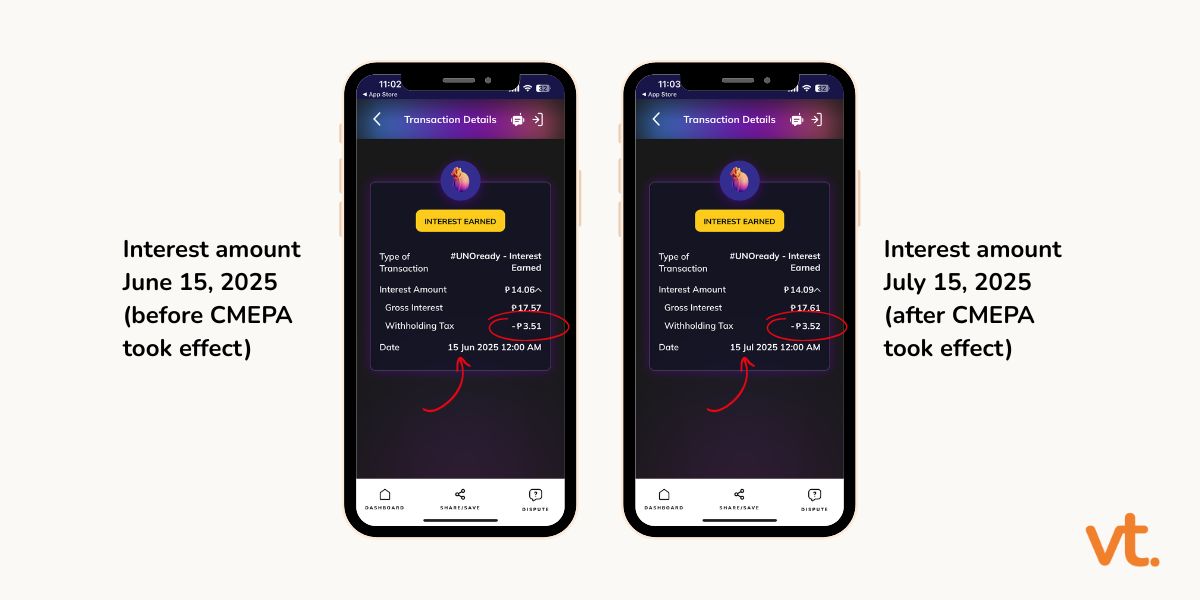

To illustrate, below is a screenshot of my interest earned from UNO Bank before and after July 1, when the CMEPA took effect.

What’s Different Under CMEPA?

So what did the Capital Markets Efficiency Promotion Act (CMEPA) actually change?

Before CMEPA, long-term deposits, such as 5-year time deposits or longer, used to enjoy lower or even zero tax on interest income. Only regular savings accounts and shorter-term deposits were subject to the full 20% withholding tax (shown above).

With the CMEPA, that special treatment has been removed. Now, all deposits, whether short-term or long-term, have a flat 20% tax on the interest you earn.

Why? Because the old system was considered unfair. It favored people who had the luxury of locking up large amounts of money for 5+ years, while ordinary savers didn’t receive the same benefits.

But, here’s the part that most headlines don’t talk about:

Investment taxes actually went down.

- The stock transaction tax was reduced from 0.6% to 0.1%, making trading significantly cheaper.

- Mutual funds, index funds, and UITFs are now exempt from documentary stamp taxes.

- Dividends and capital gains are now under a clearer, simplified tax system.

So, while long-term deposits lost their preferential tax rate, investments got cheaper!

Why This Law Exists

The simple answer: to encourage investors, not passive savers

Filipinos love to save in banks. They feel safe, familiar, and “sure.” But over time, bank deposits earn very little. Inflation quietly eats away at your purchasing power.

CMEPA is a nudge from the government saying:

- Stop relying on low-yield savings and time deposits.

- Start looking into investments that can actually grow your wealth.

- Join the capital markets, not just leave your money idle.

I would like to believe that it’s not about punishing savers. It’s about encouraging more Filipinos to participate in the economy as investors, not just depositors.

A Quick Example

Before CMEPA:

- You put ₱500,000 in a 5-year time deposit at 4% interest.

- You paid zero tax on the ₱100,000 interest income after 5 years.

After CMEPA:

- You still earn ₱100,000 interest income after 5 years, but now you pay 20% tax (₱20,000), leaving you with ₱80,000.

Meanwhile…

If you invested ₱500,000 in a mutual fund or stock index fund:

- Your transaction taxes are now much lower than before, and you could potentially earn higher returns than a fixed time deposit.

The message is clear: Move beyond just parking money in a bank.

Tax Feels Like a Burden, but Complaining Alone Is a Trap

Yes, taxes are a burden. And yes, every peso matters. But doing nothing is a victim mentality.

You can:

- Stay passive. Keep your money in the bank, let inflation win, and complain online.

- Take control. Learn how to invest, take advantage of the lower investment taxes, and make your money work harder for you.

And let me be very clear: I’m not exactly a fan of this government. I’m still mad about the taxes slapped on the digital tools I rely on as a freelancer (remember that digital services tax last June?). But living in constant frustration doesn’t move us forward.

It helps to look at what a bill really does. Sometimes, amid all the noise, there are good changes worth noticing. And in this case, CMEPA is a step in the right direction for investors. It deserves some credit because it makes investing more accessible and less costly.

Why This Matters for Filipinos

The bigger problem in the Philippines is that very few invest at all. According to the Bangko Sentral, 75 % of Filipino adults, around 54 million people, don’t have any investments beyond basic savings or loans. And if you look specifically at ownership of stocks, bonds, UITFs, or mutual funds? That’s only about 1 % of the population.

That’s why a mindset shift is so important. Bills like CMEPA are meant to nudge us to rethink where we put our money, turning us from savers into investors.

It starts by making investing more accessible through lower taxes, so it’s no longer seen as something risky or only for the wealthy. Instead of just saving for the sake of feeling “safe,” we need to start learning how to grow our wealth because savings alone won’t secure our future.

The Big Picture

CMEPA doesn’t introduce a new tax. It:

- Standardizes the existing 20% tax on all deposits (so yes, even long-term time deposits now get taxed).

- Reduces investment costs, making stocks, bonds, and funds more attractive.

Clickbait headlines focus on the “tax on savings,” but the real story is this: The government wants more Filipinos to shift from being passive savers to active investors.

So, the question isn’t whether the law is fair. The real question is: Will you stay a saver or finally become an investor?