It took me a long time to write about this. VULs (Variable Unit-Linked insurance plans) are a controversial topic, and I’ve spent more time than I’d like to admit reading through Reddit rabbit holes and finance threads. A lot of people have VULs, and many are wondering why their “investments” aren’t really growing. If you’re one of them, you’re not alone.

If you’re feeling stuck, second-guessing your policy, or unsure about what’s actually happening to your money, I’d like to share my story because I’ve been there. I’ve had multiple VULs. I believed the pitch. I paid the premiums.

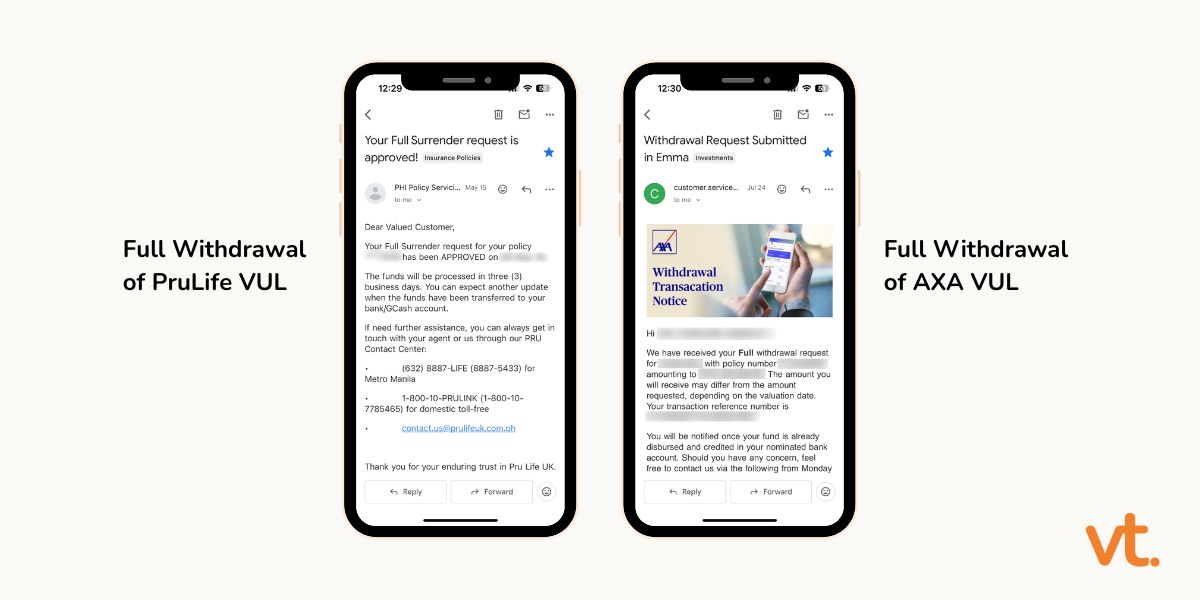

And eventually, I cashed them out.

Not because I hate insurance. Not because I’m anti-financial advice. But because I wanted something that gave me real, long-term growth without the hidden costs, lack of flexibility, and bundled complexity.

Here’s the honest version of how I went from putting my trust in a bundled insurance product to building an investment plan that actually makes sense for me.

Why I Got a VUL in the First Place

I got my first VUL in my early 20s when I started earning from my first job. I didn’t grow up learning about investing, and no one around me was talking about it. I just knew that being financially responsible meant investing some of my money.

Enter: the “financial advisor”

I was pitched a VUL as a one-and-done solution. And if you didn’t have any investing knowledge like me at that time, it honestly sounded really good on paper.

- Life insurance ✅

- Investments ✅

- Savings ✅

- Peace of mind ✅

It sounded like a smart, responsible adult decision. I was fresh out of college, earning just enough to cover my expenses. So I naturally leaned toward the VUL as a way to “hit two birds with one stone.” To be fair, VULs can work for some people, especially those who want life insurance with a small investing component in the mix.

When I started earning more, I got another one, thinking I was being smart and investing for my future. I now know I was wrong.

My Money Mindset Shift

As I started learning more about personal finance through books like Your Money or Your Life, I Will Teach You to Be Rich, The Psychology of Money, Financial Freedom, and Simple Path to Wealth, I started learning and noticing things that didn’t sit right with me.

I followed investing channels on social media, listened to podcasts like The Ramsey Show, and learned from finance educators like Jeremy Schneider of Personal Finance Club, Ramit Sethi, and others who were generously sharing their knowledge online. I read blog posts, joined money communities, and consumed hundreds of posts, podcasts, and videos on how money actually works. Even though they were based in the US, the core principles they taught were universal.

One thing that stood out? These educators consistently warned against IULs (Indexed Universal Life insurance policies), the US version of our local VULs. They didn’t just dislike them, they actively spoke out against how these products were marketed and how they worked. And the more I listened, the more I began to connect the dots.

Little by little, I started asking better questions about where my money was going and whether it was truly working for me. That shift in mindset helped me see what I hadn’t seen before. And once I started looking closer, the red flags became hard to ignore.

The Red Flags that Made Me Re-Evaluate My VULs

Here’s what eventually pushed me to take a closer look at my VULs:

1. Fees Were Eating Into My Money

I didn’t realise how much of my premiums were going to fees until I looked at my actual fund performance. The returns were barely keeping up with inflation, and I was locked into paying for years.

2. I Wasn’t Getting the Growth I Hoped For

After years of paying, the results were underwhelming. And yes, I understand that, like many investing products, VULs are meant to be held long-term. But even with that in mind, the growth didn’t add up.

3. I Had Little Control

I couldn’t freely manage my funds. I didn’t have full transparency on where my money was going. And any changes had to go through an agent. It didn’t feel like my money anymore.

4. The Investment Component Wasn’t the Star

VULs are insurance-first. The “investment” is more of an add-on, and the fees are often exorbitant for something that’s supposed to be passive.

5. NAVPU Isn’t Always Real-Time or Transparent

The Net Asset Value per Unit (NAVPU) of VULs doesn’t update instantly and doesn’t always reflect the real-time market price. That made it hard to track my money’s actual performance.

6. I Learned How Much Agents Earn from Selling VULs

I discovered that a big chunk of what I paid went into commissions. Once I understood how the product was structured, I started questioning whether it was truly designed to help me build wealth or help someone else earn from my contributions.

A Hard but Necessary Realization

So I cashed out all my VULs, and it wasn’t an easy decision.

I had already sunk years of payments. I already had regret, but after reviewing the numbers (I always run the numbers) and comparing them to what other low-cost, high-transparency options could do for me long-term, the choice became clear.

I regret the loss, yes. So I reframed it instead.

- Tuition fee: If I hadn’t signed up for those VULs, I wouldn’t have started questioning them or found better alternatives.

- Insurance value: I was covered during the years when I didn’t have an emergency fund and was earning very little. That protection gave me peace of mind.

- Avoiding further loss: Honestly? I would’ve lost more value letting the policy sit there and do nothing.

The clarity I gained was worth every peso I lost.

What I’m Doing Instead and Why It Feels So Much Better

I now invest primarily in global index funds and ETFs, using a broker that gives me access to these markets with low management fees and no unnecessary add-ons. They align with what I value, which are low-cost investments, passively managed, transparent, and built for long-term growth without unnecessary complexity.

Here’s why they work better for me:

- Lower fees: No hidden charges or commissions quietly eating into my returns.

- Transparency: I know exactly where my money is and how it’s performing.

- Flexibility: I can invest at my own pace, without being locked into years of payments.

- Passive investing: These funds are passively managed, which means lower costs and no need to constantly chase performance.

- Separation of needs: I choose term insurance separately, instead of bundling it with an underperforming investment.

- Peace of mind: I finally feel like my money is working with me, not locked behind layers of products I barely understand.

I still believe in insurance. In fact, I believe in it for what it actually is—protection. I just prefer it to be clean, simple, and separate. Here’s what I personally keep, and why:

- Health Insurance (HMO): To cover medical emergencies and unexpected hospital bills. As a freelancer, I don’t have employer-sponsored benefits, so this gives me peace of mind. I got mine through Kwik Insure. You can read my personal story with the insurance here.

- Critical Illness Insurance: To protect both my health and my investments. If I’m ever diagnosed with a serious illness, this plan provides a lump sum payout that can help cover treatment costs without derailing my long-term financial goals.

- Term Life Insurance: To leave something behind for my family. I don’t have children or dependents right now, but I still want to make things easier for my loved ones should anything happen to me.

This Isn’t Me Telling You to Cancel Your VUL

If your VUL is working for your goals, and you feel good about it, keep going.

But if you’ve been:

- Feeling uneasy about the returns

- Wondering why your policy feels vague

- Second-guessing the commitment you signed up for

Then maybe it’s time to take a closer look.

You don’t have to drop everything. You can learn, review, and explore. That’s how it started for me through books, podcasts, online communities, and just asking better questions. I didn’t figure it out all at once. It took time and intentional learning.

You deserve to understand where your money is going and whether it’s actually building the future you want.

Why This Matters to Me

I didn’t cash out my VULs out of spite. I cashed out because they weren’t aligned with what I needed: a simple, long-term way to grow my money without the fluff.

This isn’t about being rebellious. It’s about being intentional with the money I worked so hard for.

If you’re like me—a freelancer, a remote worker, a self-starter—you already carry the weight of building your own financial future. And you deserve tools that help you do just that.

Even if you’re earning a regular paycheck, you still deserve transparency, control, and long-term growth. The tools exist. You just need to know where to look.

And while I may earn affiliate income from books and tools I use, I’m not asking you to buy anything. I’m simply sharing what worked for me because I wish someone had shown me this path sooner.

It’s never too late to start learning, asking better questions, and choosing a path that truly supports the future you want.

Have a question or just want to connect? Feel free to send me an email or follow along on Instagram @virtualtita. Let’s talk freelancing, personal finance, or anything in between. And if you’d like tips and stories delivered straight to your inbox, sign up for the newsletter below.

Affiliate + Content Disclaimer: Some of the links in this post are affiliate links, which means I may earn a small commission if you buy through them, at no extra cost to you. These small commissions help keep the blog running and support the work I do here. I only share products and tools I’ve personally used or genuinely believe could be helpful. No pressure to buy anything you’re unsure about.

Please remember that I’m not a licensed financial advisor. Everything I share is based on personal experience and research. Always do your due diligence before making any financial decisions.